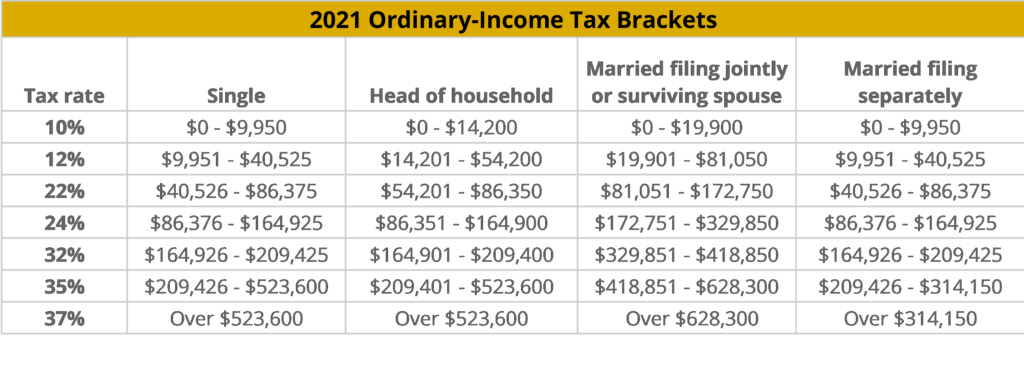

This caused the 22% rate bracket for single filer to increase from $81,051 up to $83,551.īelow are the 2020-2022 tables for personal income tax rates. The inflation adjustment factor for 2022 was 3.1% for example. There were no structural changes to the tax brackets in any of the periods, so the only impact are increases year-over-year due to the inflation indexing. The brackets are adjusted using the chained Consumer Price Index (CPI). There are seven brackets with progressive rates ranging from 10% up to 37% and they are the same over all three years.įederal income tax rate brackets are indexed for inflation. The tax rates over the period are the same. In other words, moving into a higher tax bracket does NOT mean you pay higher taxes on all your income.īelow we will present comparative tables, so you change see the changes across the years, but before we do let’s look at how the rates and brackets have changes over the periods. In other words, someone in the 24% marginal rate bracket will pay 10% on part of their income, 12% on another part, 22% on yet another and finally 24% on everything else. Tax brackets work so that you pay part of your income at each level bracket as you move-up in income.

Which bracket you are in depends on your taxable income however, your bracket does not equal your tax rate.

2021 TAX BRACKETS IRS FREE

These free programs have operated for over 50 years and use IRS certified tax. For the years 2020-2022 there are seven different brackets for each year. tax credits that were expanded and increased in 2021 will return to 2019 levels. The US tax system is progressive, meaning that the more you earn the more you pay.

0 kommentar(er)

0 kommentar(er)